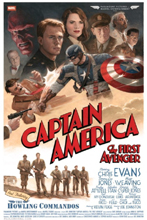

The good Captain was the original 9 pound weakling Steve Rogers, rejected by the army but given a second chance through the use of a super-serum that German scientist Abraham Erskine developed.

Erskine was killed just after Rogers' transformation by Gestapo agent Heinz Kruger.

As the debt ceiling deadlock continues with politicians point-scoring and blaming each other as the deadline-day for default looms near, I wonder what would have happened back in 1940 with today's politicians?

Surely the Republicans would have appreciated getting someone out of 4F and into the US Army but would have baulked at the costs, complaining that this action can only happen if cuts were made elsewhere?

Meanwhile, the Democrats, although worried about the ever-increasing debt would have complained that the Republicans were playing petty-politics and that action was needed now to deal with the issue of a lack of super-soldiers. Any vote in favour of the Republicans would not deal with the threat in an instance but create problems six months down the line.

Meanwhile, the Democrats, although worried about the ever-increasing debt would have complained that the Republicans were playing petty-politics and that action was needed now to deal with the issue of a lack of super-soldiers. Any vote in favour of the Republicans would not deal with the threat in an instance but create problems six months down the line. Of course, as events occured in the story, the Democrats would have won but with the killing of the creator of the Super Serum, the Republicans would go into the next elections complaining that despite the Democrats spending all that money, the country was only left with one super-soldier so how could President Roosevelt justify the costs.

Of course, as events occured in the story, the Democrats would have won but with the killing of the creator of the Super Serum, the Republicans would go into the next elections complaining that despite the Democrats spending all that money, the country was only left with one super-soldier so how could President Roosevelt justify the costs.The Tea Party would have questioned how a German scientist got a job ahead of a good old American boy and how the lack of immigration controls and decent security checks allowed the assassin to get into the lab in the first place.

Editor's note: Erskine was originally called Reinstein, why it was changed, I don't know

Editor's note: Erskine was originally called Reinstein, why it was changed, I don't know